Own Nothing, Control Everything: The Blueprint for Protecting Your Empire with Mark Lewis, EA

Most people spend their entire lives learning how to earn money, but they never spend a single day learning how to protect it.

I sat down with Mark Lewis, EA, a master of corporate strategy and asset protection, to discuss a reality that hits me deep. As an immigrant who escaped communism with $70 in my backpack, I came to America to build a legacy. But as Mark pointed out in our conversation, if you don't understand the "Rules of the Game," the system is designed to keep you in a cycle of "legal theft."

Here is the breakdown of how to move from a "sharecropper" to a true entrepreneur.

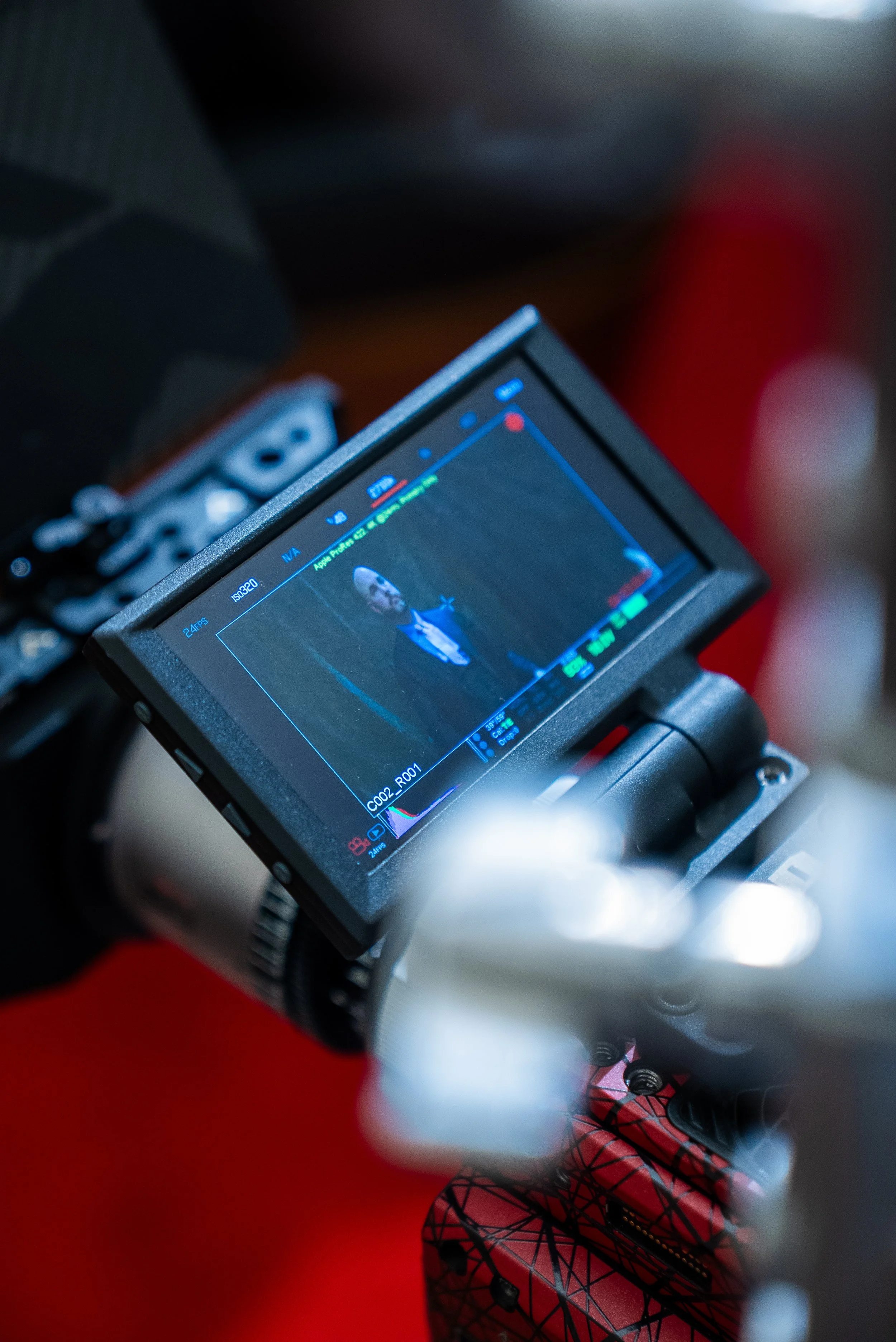

Mark & Axel on the set of the show.

Filmed in Hollywood California

1. The "Legal Theft" Reality

Mark defines a lawsuit not as a matter of right or wrong, but as a business opportunity for someone else to take your stuff. If you don't protect your money, you cannot compete in a hyper-competitive marketplace.

The goal isn't just "saving on taxes"—that’s a small-minded CPA question. The real goal is Asset Protection. You want to make your assets look so "distasteful" and legally complex that a creditor or the IRS won't even bother trying to touch them.

2. The Rockefeller Strategy: "Own Nothing, Control Everything"

John D. Rockefeller, arguably the richest man in history, followed a simple pillar: Own nothing, control everything.When you own an asset in your personal name—whether it’s liquid gold, a house, or a bank account—it is vulnerable to every liability you have. By using a corporate structure (C-Corps, LLCs, and Trusts), you "put the asset into service."

As Mark illustrated with his "liquid gold" example: if you loan your assets to another entity via a legitimate contract, you still control the value, but a creditor cannot seize it because it is technically "tied up" in a contract. If you don't have it, nobody can take it.

3. Breaking the "Sharecropping" Cycle

Mark introduced a heavy concept: Modern Sharecropping. * You work a W2 job.

You pay 40–50% in combined taxes (especially in states like California).

You spend what’s left on goods provided by the same corporations that paid your salary.

You are told to "save" your money in a bank where inflation eats the value.

The Escape Hatch: You must move from being an employee to an employer. Capitalism in America is designed to benefit the owners of the business, not the workers.

Mark Lewis on wealth strategy

"John D. Rockefeller, arguably the richest man who ever lived, had a simple rule: Own nothing, control everything. He wasn't just talking about trusts; he was talking about a corporate structure that allows you to put your assets into service while keeping them out of your own name."

4. The Tax Freedom Day

In Tennessee, "Tax Freedom Day" (the day you stop working for the government and start keeping your money) is in March. In California, it’s early June.

That means for nearly half the year, you are a volunteer worker for the state.

By utilizing the same 12-figure corporate structures that monolithic distributors use, you can often cap your federal tax at 21% flat.

That is a revolutionary competitive advantage.

Axel Axe on coming to the U.S.

"I didn't escape communism to come to America and lose my hard-earned freedom to poor planning. Whether you’re a creative, a founder, or a high-earner, you have to realize that the freedom we have here isn't just about the right to speak—it’s about the right to build and protect a legacy."

5. Legally Paying Your Kids Tax-Free

One of the most tactical gems Mark shared was how to build generational wealth by hiring your children.

You can pay each child up to the standard deduction (approx. $15,750 for 2025) tax-free to them.

Your company gets a 100% tax deduction.

The kids don't pay FICA or withholding if structured through an LLC.

If you invest that money back into the business or an investment vehicle, a child who starts at age seven can have nearly $800,000 by the time they are 21. You are teaching them fiduciary responsibility while legally moving money out of the reach of the IRS.

Axel and Mark discuss how to break the cycle of working just to get by

“Asset protection isn’t just about winning or losing in court—courts are just a circus. It’s about making your stuff look so distasteful that someone’s probably not going to want to sue you in the first place.”

Final Thought: The American Advantage

Mark left us with a powerful reminder: the tax benefits available to Americans don't exist anywhere else on the planet. In Australia or Europe, you might face a 47% flat tax with no "loopholes."

In America, the tax system is voluntary—not in the sense that you don't pay, but in the sense that you choose how to organize yourself. If you choose to stay a "peeon," you pay the peeon rate. If you choose to organize at the highest level, the highest level of protection is yours.

Stop working for the system. Start making the system work for you.

Mark Lewis and Axel Axe

“In America, you choose how to organize yourself. When they say this is a voluntary tax system, it means you get to choose. Why not organize at the highest level available? You won’t find the tax benefits that Americans have anywhere else on the planet.”